By: Najmeh Bozorgmehr

Iran plans to keep most of the $100bn in assets it holds in foreign banks out of the country now the funds have been unfrozen, in a bid to fend off inflationary pressure from a sudden injection of cash into its economy, according to the country’s vice-president.

“The money will not come to Iran,” says Mohammad-Bagher Nobakht as he outlined plans for how the government would deal with the assets released following Iran’s nuclear agreement with world powers last year. Instead, he said, “we will use it the same way as oil revenues”, with the central bank opening letters of credit for domestic companies, taking their payment in rials and paying overseas creditors in hard currency.

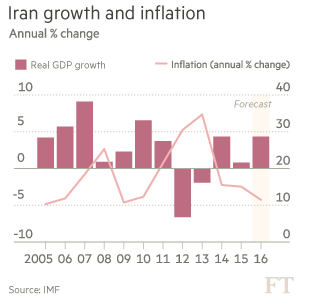

Despite high levels of public debt, analysts say, Tehran plans to direct the funds at infrastructure projects and the purchase of capital goods in a bid to end a recession that has seen negative growth in most years since 2011 and sent youth unemployment to 25 per cent.

After years of sanctions, populist policies under former president Mahmoud Ahmadi-Nejad and falling crude prices, local media put the country’s public debt at around 3,800tn rials ($125.8bn) — almost half of gross domestic product and the highest ratio since the end of its war with Iraq in 1988, analysts say.

The central bank is also owed about $50bn which it loaned to Nico, a Swiss-based subsidiary of the National Iranian Oil Company, to be used for the continued development of oil projects during the sanctions era.

But after struggling to cut inflation from about 40 per cent to 13 per cent in the past two years, the centrist government of president Hassan Rouhani is concerned about the economic impact of a sudden influx of assets.

Only about $7bn of the unfrozen assets belong to the central administration and will be transferred to Iran, converted to rials and used for development projects, Mr Nobakht says.

The rest includes about $38bn in central bank foreign exchange reserves held in a basket of currencies; up to $50bn belonging to the National Development Fund of Iran, the sovereign wealth fund that collects oil price windfalls for infrastructure investment; and about $6bn that belongs to state-owned companies and banks.

Mr Nobakht, who heads Iran’s planning and management organisation, which drafts the annual budget and supervises spending, says the assets have largely been stuck in China, India and Japan since international nuclear sanctions were imposed in 2012. With China the top importer of Iranian oil in the period, most of the assets are in Chinese banks, say Iranian bankers.

The government’s debts include payments owed to contractors for nearly 3,000 development projects, including sports stadiums, schools and hospitals. Many of these were pledged by Mr Ahmadi-Nejad at a projected cost of $132.5bn, but Mr Nobakht says the government will now only finance those that are more than 80 per cent complete.

Other debts include end-of-service gratuities owed to retired public sector employees, which amount to $14.9bn, he says, and about $21.5bn owed to banks — a figure the central bank puts at about $33bn.

The government plans to pay the retirees this year and settle its bank debts in the next five years, Mr Nobakht says.

But Tehran will “resist” paying debts owed by the country’s highly indebted state-owned companies, which need to generate revenues to pay what they owe each other and the banking system rather than borrowing from the government, he warns. The companies have not been named but some MPs have threatened to disclose the identities of any that attempt to avoid paying their debts.

The companies could tap a range of sources for funds, including the government development project budget, the sovereign wealth fund, the capital markets and the banks, Mr Nobakht says, as well as the $9bn Tehran hopes to attract in foreign direct investment this year.

“Our [five-year development] plan [to start in March] is based on achieving a GDP growth of 8 per cent annually within the next five years . . . [which means] the gross fixed capital . . . should increase by 15.4 per cent, for which we annually need 5,800tn rials,” he says.

“We have a three-dimensional investment policy. The first priority is FDI. The second is with those investors who bring the latest technologies. And third, those who help us create a market outside Iran.”

Italy and France signed multi-billion-dollar contracts with Iran last week to invest in infrastructure and the car industry, buy oil and sell civilian aircraft.

However Iran needs much more financing than Europe — struggling with the aftermath of the financial crisis and a wave of migration from the war-torn the Middle East and elsewhere — can provide, a senior western diplomat says. China is a significant source of financing, the diplomat says, adding: “The rivalry is not between France, Italy and Germany. The main rivalry is between Europe and China.”

But the Islamic Republic is keen to diversify its investment partners after being largely dependent on China during the sanctions era. “There was a time when there was only China,” says Mr Nobakht. “But now there is China . . . and the rest of the world.”

khalijefars News, Blogs, Art and Community

khalijefars News, Blogs, Art and Community