THE TELEGRAPH-

As Iran emerges from decades of sanctions, London may see an influx of cash from investors looking for a safe bet

By Isabelle Fraser-

The end of economic sanctions on Iran could spell a new opportunity for the UK property market.

The lifting of sanctions last weekend has unlocked an estimated £70bn of Iranian assets – and the luxury London market is line to benefit.

As major foreign investors in British property are hit with crises – from recession in Brazil and low oil prices in the Middle East to currency problems in Russia and a slowdown in China – newly liquid Iranians may be just the tonic.

Jennet Siebrits, head of residential research at CBRE, said that Iranian money “could well become a major force in the London residential market”, adding that it had the potential to be “on a similar scale to the investment we see coming from Asia, such as those from Hong Kong or Singapore.”

Becky Fatemi, the Iranian managing director of London-based luxury estate agency Rokstone, estimates that as a result of sanctions being lifted there will be a 25pc upturn in Iranian buyers looking for homes in London and the home counties this year.

Iranians celebrate in the street of Tehran, Iran, after nuclear talks between Iran and World powers ended in Lausanne, Switzerland

Statistics from New World Wealth show there are 32,000 high net worth individuals (HNWIs) in Iran, including 65 individuals worth over $100m (£71m) and four billionaires. This number of HNWIs is expected to grow by 70pc over the next 10 years, and with sanctions lifted, Iran’s GDP could rise by 5pc in 2016.

Sanctions were first imposed in the 1970s, but increased in the 2000s over tensions surrounding the regime’s nuclear ambitions. They applied not just to specific people connected to the nuclear programme, but also to ordinary people; restrictions were put on money transfers, for example, and banks avoided dealing with Iranians because of worries about breaching legislation.

The UK has long been a centre for Iranians: 80,000 are estimated to live here, with many arriving after the Shah, Mohammed Rez Pahlavi, was overthrown in the 1979 revolution. Those historic ties are likely to lead to Iranians returning, and reinvesting.

Los Angeles also has a big Iranian population. With a suburb nicknamed ‘Tehrangeles’, there are an estimated 500,000 Iranian-Americans living there. The community even has two reality TV shows about it, including one, ‘The Shahs of Sunset’, about Iranian estate agents. But US ‘primary sanctions’ remain, meaning that US nationals and companies are still banned from engaging in business with Iran. That makes London a more likely destination for Iranian wealth.

The Shah of Iran, Mohammed Reza Pahlavi, and his wife, Farah Diba

There is a sizeable community of Iranians in north-west London, and Ms Fatemi said she had already received inquiries for properties in St John’s Wood and Hampstead. “The ties are already in LA, Germany, Switzerland and London, so I think they are going to go back to those ties, and reinvest.

“I think that London is the safest of those because a lot of properties are in a conservation area [where building alterations are restricted] and the values hold.”

London and the home counties will be the most popular areas, Ms Fatemi said, predicting that buyers would spend anything from £1m to £30m on a home there. “The grandparents and older generation still remember, so buyers will look – as they did in the 1960s and 1970s – at Knightsbridge, Mayfair, South Kensington and St Johns Wood.”

The Shah himself owned a huge estate in Godalming, Surrey. Ms Fatemi’s grandmother was lady-in-waiting to the Queen of Iran; her family fled in 1979 to Kuwait, then settled in London, after members of her family were executed in the revolution.

A demonstration against the Shah in 1979

“During the 1960s and 1970s Iranians and Greeks were the largest buyers of luxury property in Knightsbridge and Mayfair,” she said. “The Iranian elite – and by that I mean the top 10pc of the country in terms of wealth – would send their children to school in either the UK or USA and the fashion was to own an apartment in London or Paris, come shopping to Europe in the summer, and own a villa on the Riviera.”

Education is a key part of the attraction, with Britain’s education system particularly appealing. “With a resurgence of old money, the one place they go to is London – as the Russians did, where they get a good education,” said Ms Fatemi, who was born in Tehran before being sent to boarding school in England as a very young child.

Ms Siebrits said: “It won’t just be that investors want somewhere to park their money, it’ll be the whole round. They will want their children to have their university education in London and they will buy them a flat to live in.“

However, it will take some time for Iranian money to make its way out of the country.

“It’s not going to be like opening a tap, I don’t think tomorrow we’re going to see a stampede of Iranian investors outside Canary Wharf, but I suspect it’s going to be a drip, and it’s going to be an ever-increasing drip,” said Ms Siebrits.

Adam Challis, head of residential research at JLL, said that in the immediate future, Iranian investment would go towards rebuilding the economy and infrastructure there, as more than $30bn (£21bn) that was frozen in accounts around the world can now be brought back into the country.

In the UK, “there will relatively low impact in the short term, but over the next few years, [we will see] an increasing flow from Iran as economic relations normalise”.

It is not yet known what kind of investors Iranians might be. “The different countries or geographical locations have very different type of investments,” Ms Siebrits said. “In the Middle East, they are very high net wealth families; they like big ticket items and they like to invest in developments and build to rent.

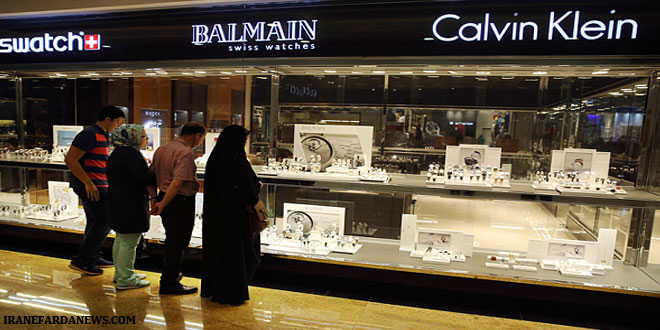

Designer goods on sale in Iran, where businesses are seeking lucrative opportunities

“The Asian investors, from Hong Kong and Singapore, like to buy a number of individual items, which are not so big ticket value. And then there are big Asian developers, like the Chinese.

“Until we see what’s going to come out of Iran, it’s difficult to make that call.”

Ms Fatemi agreed: “It’s going to be gradual, and it will take a year for people to look at their tax structuring, a year until people believe that it’s actually happening.

“Even though there are celebrations on the streets of Iran, people are also thinking that this can be reversed very quickly.”

khalijefars News, Blogs, Art and Community

khalijefars News, Blogs, Art and Community